Updated April 23, 2024

We searched for the latest codes!

Recommended Videos

Murder Mystery 2 is a survival experience in which you must figure out who the killer is to stay alive. Whether you’re a sheriff, murderer, or innocent, you can use Murder Mystery 2 codes to get free weapons and cash to buy emotes, effects, and more!

All Murder Mystery 2 Codes List

Active Murder Mystery 2 Codes

- There are no redeemable Murder Mystery 2 codes at the moment.

Expired Murder Mystery 2 Codes

- R3PT1L3

- G1FT3D

- PATR1CK

- INF3CT3D

- C0RL

- AL3X

- NatureUpdate

- SUB0

- 2015

- PR1SM

- SK00L

- COMB4T2

- SK3TCH

- G003Y

- N30N

- TH3N3XTL3V3L

- D3NIS

- HW2017

Related: Shindo Life Codes

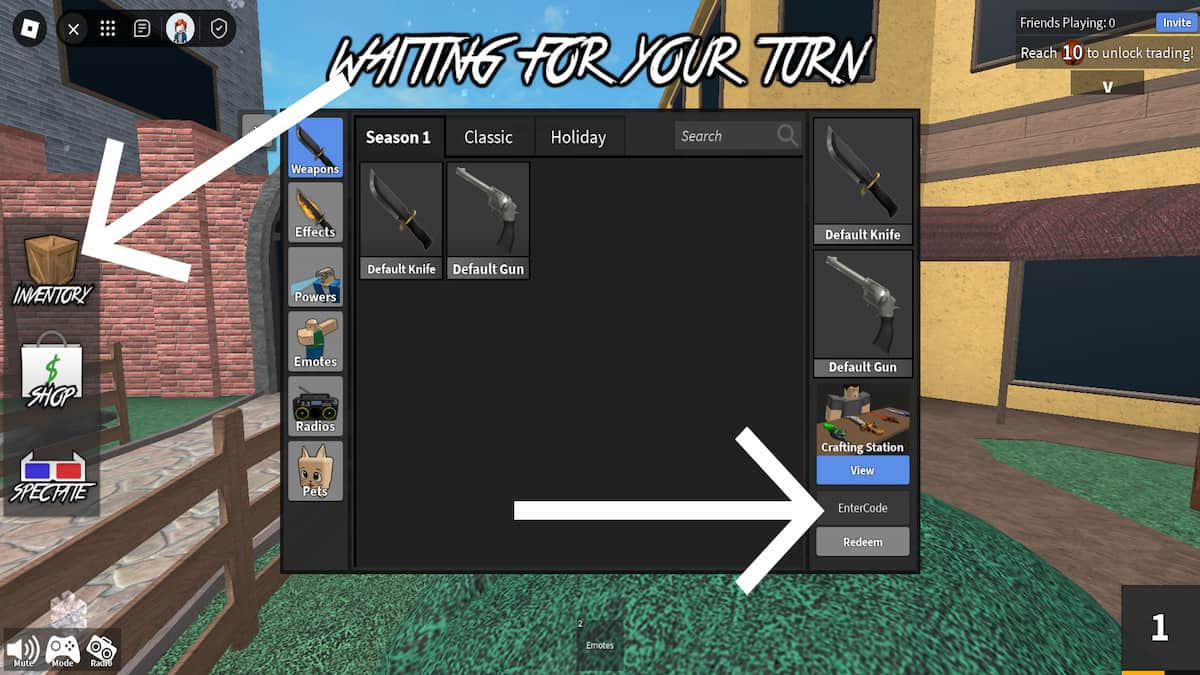

How to Redeem Codes in Murder Mystery 2

To redeem codes in Murder Mystery 2, check out our tutorial below:

- Open Murder Mystery 2 in Roblox.

- Go into the inventory by clicking the crate icon on the left.

- Type the code into the text field in the bottom-right corner.

- Click Redeem to get your rewards.

If you want to redeem more codes, you can find them in our articles like The Undead Coming Codes and Driving Empire Codes—just do it fast before they expire!

The Escapist is supported by our audience. When you purchase through links on our site, we may earn a small affiliate commission. Learn more