To evolve your Haunter into Gengar in Pokemon Scarlet & Violet, you need to trade with another trainer. Typically this means finding someone who’ll connect online to trade, but in this case, the game offers another solution – a friendly NPC who’ll happily trade you their Haunter. As soon as it gets to you, her Haunter will evolve into Gengar before your eyes.

Where to Find the NPC to Trade Haunter in Pokemon Scarlet & Violet

The NPC who’ll trade you their Haunter is located in Levincia, one of Paldea’s larger cities east of the Great Crater.

Her name is Blossom, and you can find her in the center of Levinicia, near the battle court where you faced off against Iono. You’ll see her standing in the outer ring of the PokeBall-shaped court area, closer to the Southern side of the city. She’s easily recognized by the yellow dialogue bubble that announces, “A Pinchurchin would be great!”

If you talk to her, she’ll ask if you’d be willing to trade a Pinchurchin for her Haunter. Now that you’ve found your trade partner, you’ll need to ensure you’ve got the right Pokemon to swap.

How to Search Your Inventory for a Pinchurchin to Trade

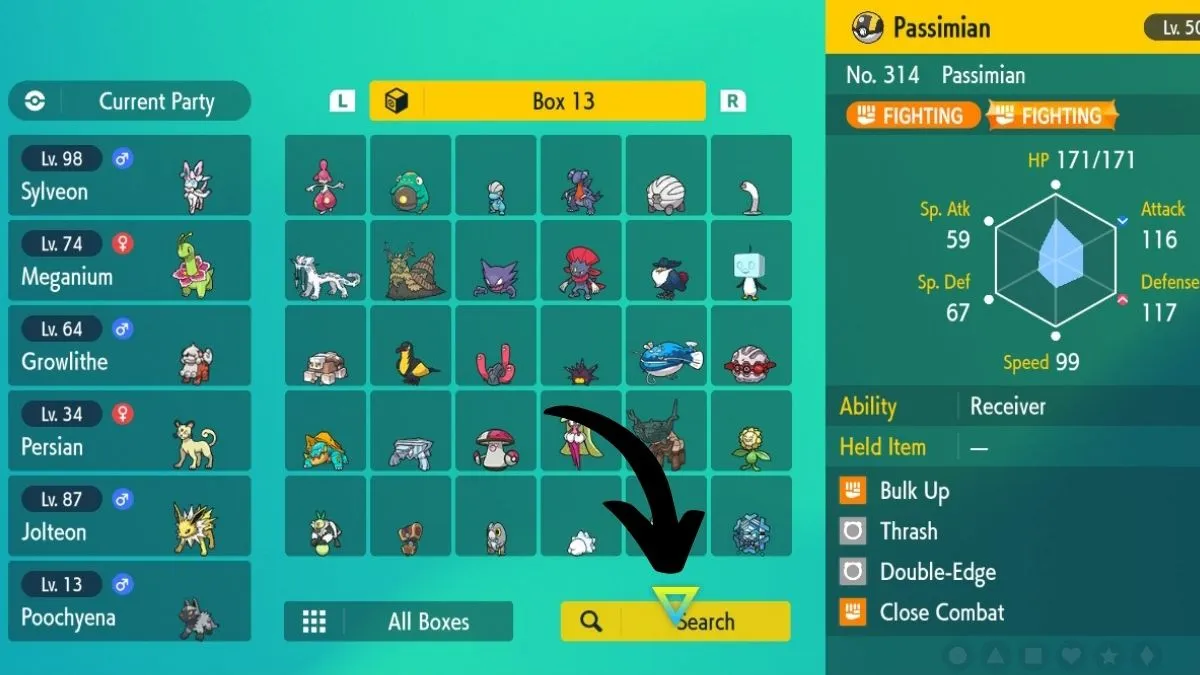

To check if you have the right Pokemon, say “yes” when she asks you to trade. Then, use the search function in your Pokemon box to see if you have a Pinchurchin.

If you do, the box that this Pokemon is housed in will turn green. You can easily click on the box and all Pokemon that are not Pinchurchin will be greyed-out. If you have Pinchurchin, you can select it and proceed to trade with Blossom for her Haunter.

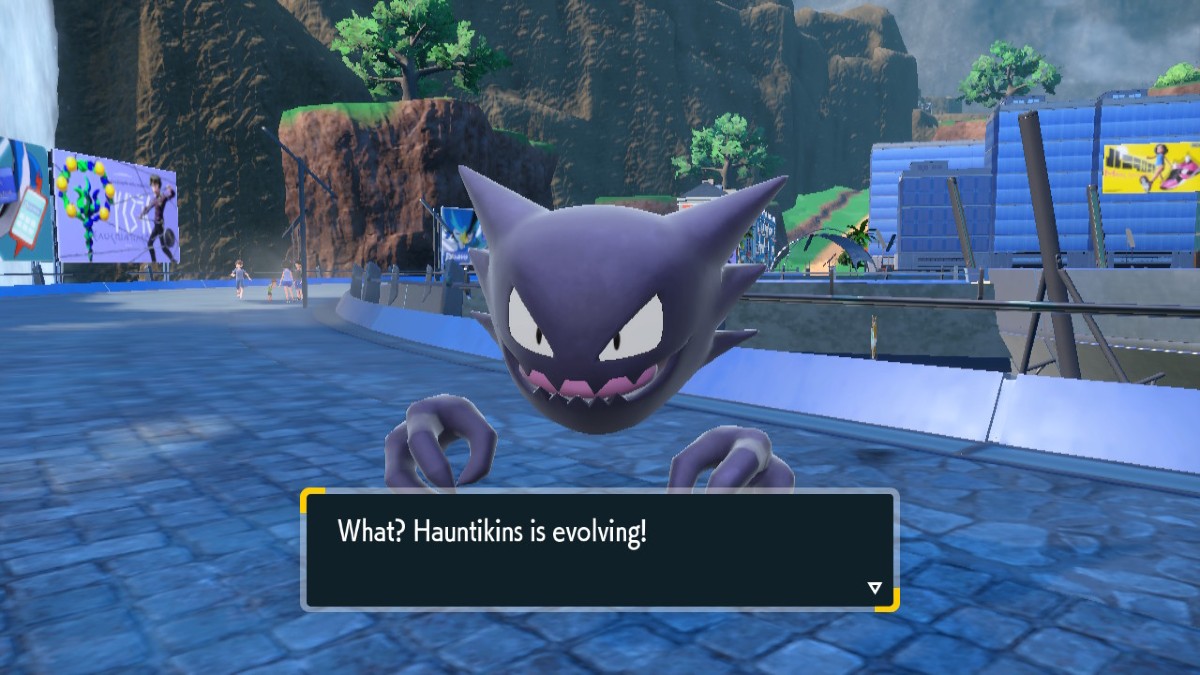

Once the trade is complete, your new Haunter will immediately evolve into Gengar. Fair warning – it has the nickname “Hauntikins” and you can’t rename Pokemon that you got via trades.

Not seeing Pinchurchin in your Pokemon Box? Don’t worry, we’ll cover where you can catch it.

Where to Find Pinchurchin in Pokemon Scarlet & Violet

If you still need to catch a Pinchurchin to trade for Haunter, you can find one at the nearby Levincia coastline.

Pinchurchin can be found in any sandy area of Paldea near the ocean, including the coastline of Levincia city, where you just found Blossom. In my experience, Pinchurchin is a bit harder to find than other coastal Pokemon like Wiglet and Slowpoke. You may need to explore the beach for a bit, but you should eventually run into one.

Pokemon Scarlet and Violet are available now on the Nintendo Switch.