One of the earliest encounters you can have in Another Crab’s Treasure is the Royal Shellsplitter hanging around in The Shallows. Whether you’re actively trying to overcome it or were just dragged out to this fight by accident, here are some tips to help you show who’s boss.

How to Beat the Royal Shellsplitter in Another Crab’s Treasure

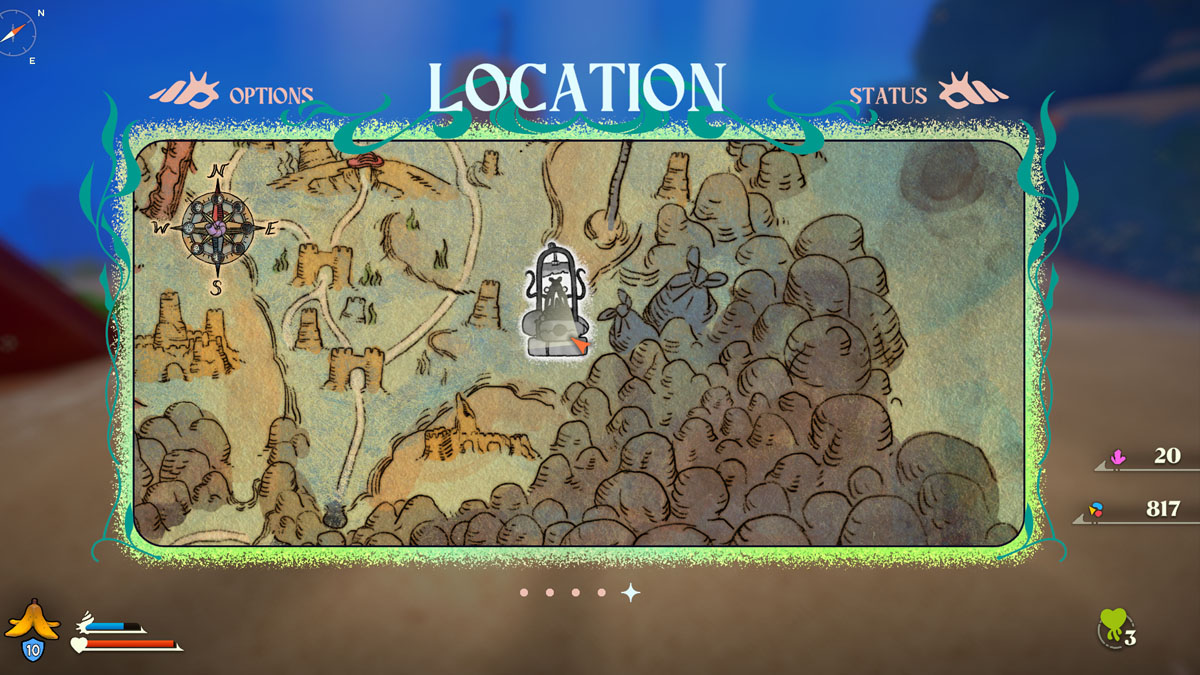

The Royal Shellsplitter is located next to the entrance to The Shallows, close to the first snail NPC you meet at the beginning of the game. You might encounter it as your first boss instead of Nephro, which means you’ll have no shell to hide yourself. If that’s the case, my best advice is to advance to the Castle and fight Nephro first to unlock Shells, or the fight will be unnecessarily harder.

But if you choose to suffer (understandable, we’ve all been there), hold your fork firmly in front of your chest and head straight into battle. As this is an early boss, it doesn’t have much health and can be dealt with quickly. But in the same vein, it can crush you to pieces in a second.

Royal Shellsplitter Attacks and Moves

Lunge: Charges at you with its claw when in close distance.

Padlock Charge: Smashes the ground after a wind-up using the padlock. Has the Aggro indicator.

Grab: Tries to grab Kril with its claw. You instantly die if you’re hit. Has the Aggro indicator.

Deadlock: Uses its padlock to hit the target in front of it. Has both a single-hit and a triple-hit variants.

Frighten: Scares Kril with its face over the padlock, increasing the Frighten bar. Does nothing if Kril isn’t looking directly at it.

Despite its looks, the Royal Shellsplitter isn’t that frightening at all. The key is maintaining distance while slowly wearing it down when it goes for simpler attack. It usually resorts to Lunge and Deadlock, and both can be dodged backward. Just make sure to respect Deadlock, as it randomly uses the three-hit variant.

When dodging his attacks, try to keep positioned to the Shellsplitter’s side instead of directly in front of it. This helps avoid filling your Frighten gauge, which renders you unable to attack. It also helps with dodging Padlock Charge, which isn’t as difficult to evade, fortunately. Use these chances to strike and break his Balance with a charged hit and go for an all-out assault.

And most importantly, be careful with the Grab. The crab icon (the Aggro indicator) pops up way before it happens, so lock some distance as soon as you see it. Otherwise, you’re dead and there’s nothing you can do.

Related: Is Another Crab’s Treasure Coming to Xbox Game Pass?

Don’t be afraid to spend your Heartkelp as they’re refunded whenever you visit another Moon Snail Shell. As long as you’re alive at the end of the day, you’re good.

If things still are going south and you haven’t obtained your Shell just yet, consider returning here later once you have one. While it won’t protect you from the insta-kill Grab, it’ll help tremendously against regular attacks.

Even if it takes an extra try or two, but once you’ll finally defeat the Royal Shellsplitter, you get five Purple Crystals and a Clothesclaw (equal to 1000 Microplastics). Congratulations on defeating your first (or maybe second) boss! Now on to the next opponents!