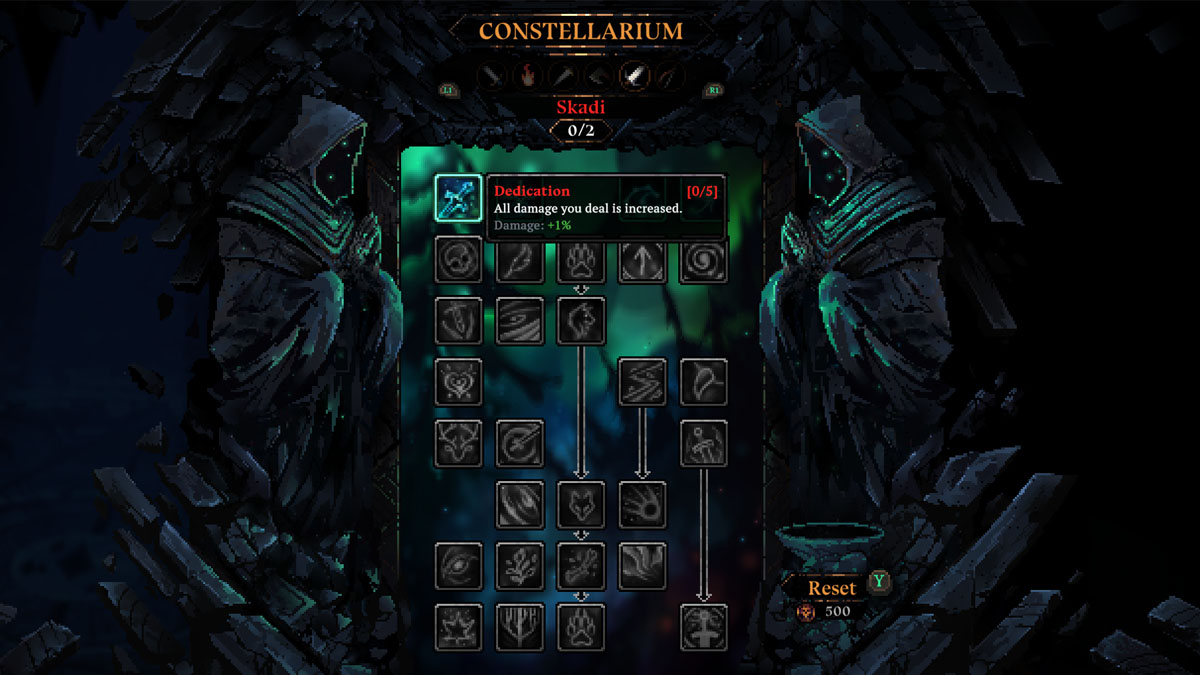

The Act 2 update for Death Must Die brought a whole overhaul for characters’ builds by introducing the Constellarium system. This new skill tree allows you to customize your characters to a whole new degree, and here is how it works.

How to Unlock and Use the Constellarium in Death Must Die

The Constellarium replaces the old Talent system from Death Must Die Act I. You unlock it as you defeat your first boss (A.K.A The Necromancer), and can find it in front of the Star Crux altar. Each boss drops at least one Cosmic Fragment, which is used as currency for the Constellarium. Final bosses such as Dracula drop two.

In the Constellarium, you can unlock various buffs for your character, such as more Experience, Banish/Reroll/Alteration dice or more raw damage. They quickly scale up to special effects such as extra attacks, invulnerability periods or other powerful abilities inaccessible otherwise. Many of them can be enhanced multiple times to increase your bonus.

Unlocking stronger talents requires having enough points invested beforehand. They’re usually overpowered effects very similar to those found in special equipment dropped in battle. Many of the old Talent abilities from the previous system are now found in the Constellarium skill tree, and don’t require specific achievements to unlock anymore.

Related: Everything We Know About Death Must Die’s Act 2 Update

This makes the system much more akin to traditional roguelike games, where you get stronger after each attempt. With each run you complete in Death Must Die, whether it was successful or not, you’ll end up coming out stronger. Providing you defeat at least one boss, of course. You still need some powerful equipment to complement your build, but it’s easier to reach the big bosses with more consistent base power.

And don’t worry about messing up your build. You can always reset it for 500 Gold, which you obtain in the first few minutes into a run. Take it as an incentive to try out some new builds and experiment with new ways to defeat Death itself (when he’s finally around, at least).